Currency Update December 2023

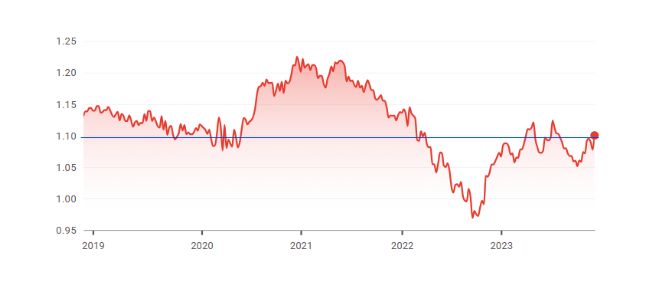

EUR/USD

The US dollar weakened by 1% on the back of an interest rate announcement from the Fed.

In one day it became $3,000 more expensive to buy €250,000.

Although rates remained unchanged, the predictions were that rates may be cut up to 0.75% throughout 2024, which has weakened the Dollar.

The main focus is still inflation data and interest rate announcements. As inflation is heading closer to the central bank's 2% target, the Fed and ECB may no longer need to raise interest rates.

The ECB kept interest rates steady today while downgrading its inflation forecasts. The confession by the Central Bank regarding a possible uptick in inflation in the near term saw the Central Bank reiterate the need to keep rates at the current level. Therefore, they may not be in a position to cut interest rates just yet.

While the Fed took a similar initiative to keep rates on hold, they see the need to cut interest rates next year.

Historically

If we look back at the last 5 years, while buying Euros has become more expensive, it is still cheaper than where we have seen the exchange rates historically.

Many customers take advantage of rate improvements when they can, buy Euros in advance, or lock the rate to help them budget and ensure their Euros are not more expensive.

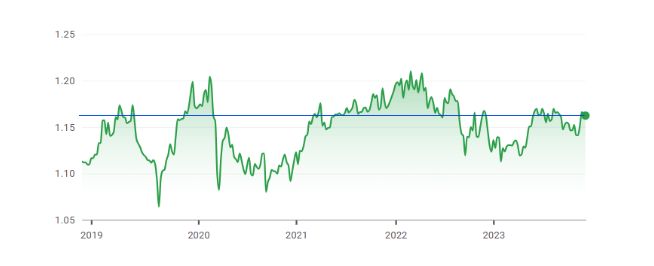

GBP/EUR

The Bank of England has kept interest rates at 5.25% heading into 2024. However, similarly to the Eurozone, there are still concerns for higher inflation data to emerge. All eyes will be on the Bank of England and ECB to see who cuts interest rates first and who chooses to maintain or hike rates.

If we look back over the last 5 years you can see that we are currently trading at very good levels. Anyone who needs to buy Euros now or chooses to buy Euros in advance would find their Euros to be extremely affordable.

What are my options?

Option 1 - Buy your Euros in advance

There is no minimum, and Spartan FX can hold your funds on account free of charge.

Option 2 - Fix the rate with a 10% deposit

Fix the rate for a payment that needs to be made in the future.

Option 3 - Split your transfers

Buying 25-50% of your Euros now means that if the rate moves against you in the future, the average rate at which you will have bought your Euros will be better. This helps to spread your risk.

If you want any certainty with your currency exchange, feel free to contact us and we can explain all of the options available to you.

GET A FREE QUOTE HERE

OR

CALL NOW +44(0)203 984 0450

Copyright (C) 2023 Spartan FX. All rights reserved.

www.spartanfx.co.uk

Our mailing address is:

Spartan FX

Pixel Business Centre

110 Brooker Road

Essex, Greater London EN9 1JH

United Kingdom