Investments In Portugal

Looking to cash in on opportunities? Here are 3 types of investments in Portugal that are getting popular lately.

Article by Viv Europe - Official Legal and Relocation Partner to KipperTree

20 09 2023

Read the full article here

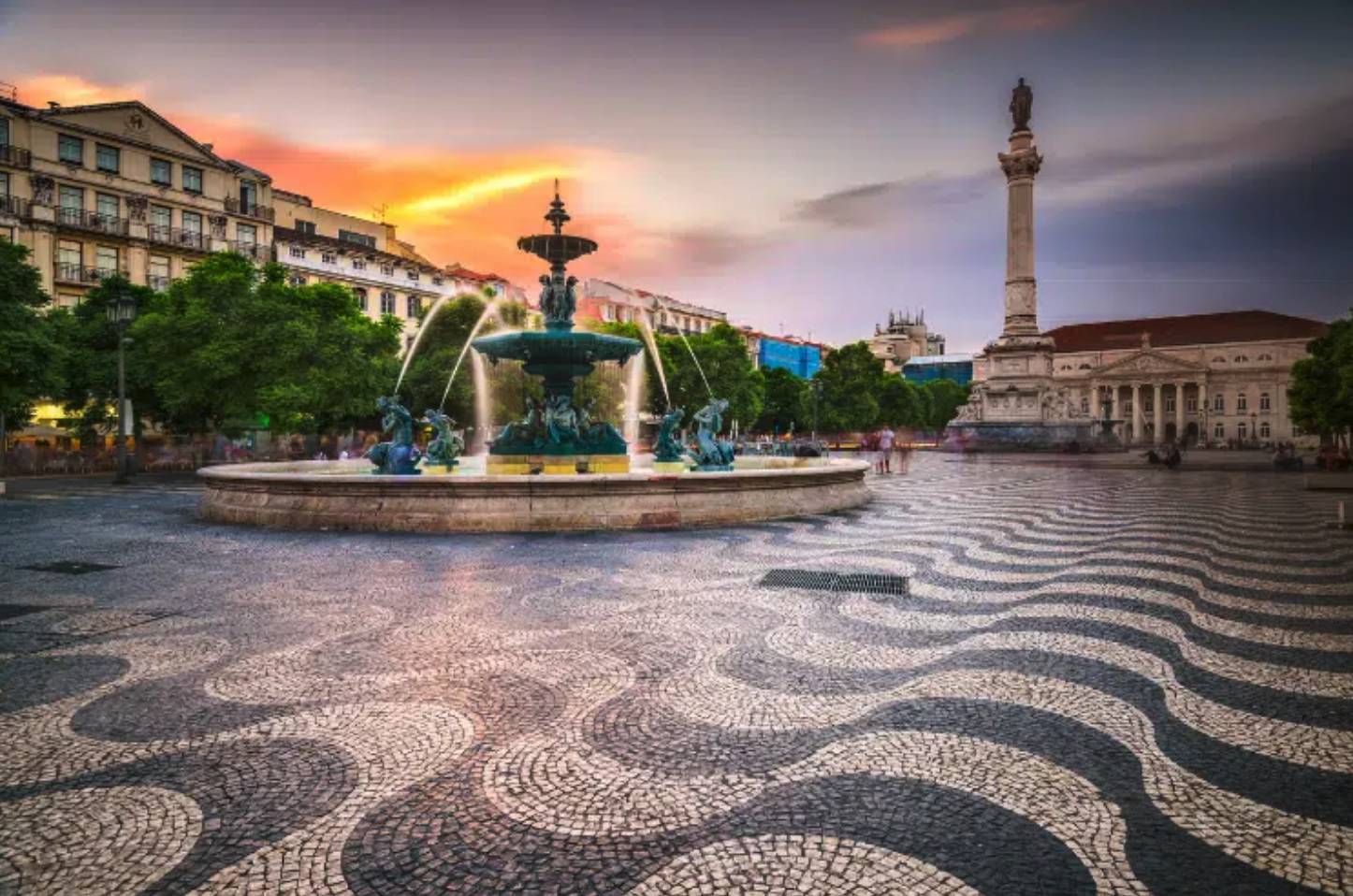

Portugal isn’t famous only because of the pretty beaches and nice weather. Experts from around the world point to the country as a land of opportunity. An opportunity to upgrade your lifestyle and an opportunity to make more money. There are 3 types of investments in Portugal that foreigners are cashing on.

But what types of investments in Portugal are on the rise? Which ones are more profitable with less risk? How long could it take for you to see any return on investment? We’ve got you covered.

Take a look at our tips for investing well in Portugal from the point of view of analysts and expats. This article will help guide you on what the market looks like, why people are investing, and what lies ahead. Follow up!

3 types of investments in Portugal

Portugal is in vogue. The southern European country overcame the 2008 crisis, stabilized, and is increasingly attractive. Everybody wants to go to Portugal, and people want to explore how they can invest in the market here.

In this article, we will analyze some investment opportunities in Portugal that are not associated with granting a visa but with the capital return itself. According to experts, the top 3 types of investments in Portugal are as follows:

Real estate investment

Capital investment

Investment in a technology-related business

Of course, a good investment must be accompanied by caution and knowledge of the market. Therefore, follow the article to learn more about each of the types of investments in Portugal.

We do recommend that you do extensive research and weigh all your options before making the final decision. If you’re looking to talk to experts, Viv Europe is here to help every step of the way.

Why invest in real estate in Portugal

When it comes to rental activities:

Low cost: In Portugal, condominium fees are very cheap or non-existent in most buildings.

Variety of use: The possibility to rent properties through online rental services such as Airbnb and Booking has become the practice in many cities.

Tax: Portugal allows the use of the simplified system (presumed profit) for the payment of income tax from short-term rentals.

Economy: Stable economy and support from the European Community.

When it comes to real estate valuation:

Demand: Due to the arrival of people from all over the world (including investors), the number of properties available is much smaller than that of those who want to buy.

Cities development: with cities growing due to the arrival of new companies, the construction of shopping malls, etc., the price of real estate will increase at the same level.

Therefore, investing in real estate in Portugal seems more profitable and beneficial if well-planned.

According to Fipezap, Portugal has the best return rate for residential rentals per year. That’s ahead of Denmark, Cyprus, Brazil, Belgium, and Luxembourg.

If you want to check everything you need to buy a property in Portugal, read our article Complete Guide to the Real Estate market in Portugal.

Capital investment

Besides the Real Estate investments, we have the bank investment.

How much can you profit by investing in a fund managed by the bank?

Portugal is known for its low interest rate, which favors those who want to take out a bank loan.

On the other hand, if you “lend” (invest) your money to the bank, the return will not be great compared to other European banks.

If investing in a bank doesn’t seem profitable, we can’t say the same about private funds. Mainly real estate and why is that?

As these assets are associated with the development of the real estate market (the buying and selling of properties), and considering that, despite the COVID crisis, these transactions continued occurring regularly, this type of investment can be rewarding.

“The funds can present an average return of 2.8% (0.6% in 3 years). The income accumulated in these funds, also called capitalization, is included in the value of the unit, increasing its value.”

As reported on Jornal de Negócios

As an example, Imopoupança, a real estate fund managed by BPI, had an average return of 7.2% per year.

To read all about Technology-related business investment

Click here