Portugal Capital Gains Tax On Property

Article By Portugal Residency Advisors - Official Legal and Residency Partner to KipperTree.

18 09 2023

Read the full article here.

Are you in the process of purchasing or selling property in Portugal? Whether it’s your initial home purchase or the sale of a vacation property it’s crucial to understand the Portuguese capital gains tax regulations when it comes to property transactions.

The amount of tax you’ll owe hinges on several factors, including your residency status in Portugal, whether you’re selling while under non-habitual residence status, and your eligibility for tax relief.

What is capital gains tax?

As seasoned investors, our aspirations often centre on making astute property acquisitions in Portugal. Over time, we anticipate the appreciation of these assets, envisioning the day when we can reap a substantial profit.

This profit, often coined as a ‘capital gain,’ emerges from the variance between the property’s selling price and the initial purchase cost. However, it’s imperative to recognize that this financial gain is not entirely yours to keep, as it incurs taxation upon sale.

The taxation of capital gains is a crucial consideration in any property investment strategy, especially when dealing with Portugal's capital gains tax. The extent to which you can mitigate or potentially circumvent this tax liability hinges on a multitude of factors, including your understanding of Portugal taxes and the specific rules related to Portugal expat taxes.

Capital Gains Tax for Portugal Residents

Portugal residents are subject to worldwide property and investment gains tax as part of the country’s tax regulations, which includes tax rates in Portugal. Properties acquired prior to January 1, 1989, are exempt from capital gains tax.

Only 50% of the profit gained from the sale of real estate is considered taxable income, which is a crucial aspect of the Portugal tax rate for expats. This effectively reduces the taxable portion of the gain, making it more favourable for property sellers.

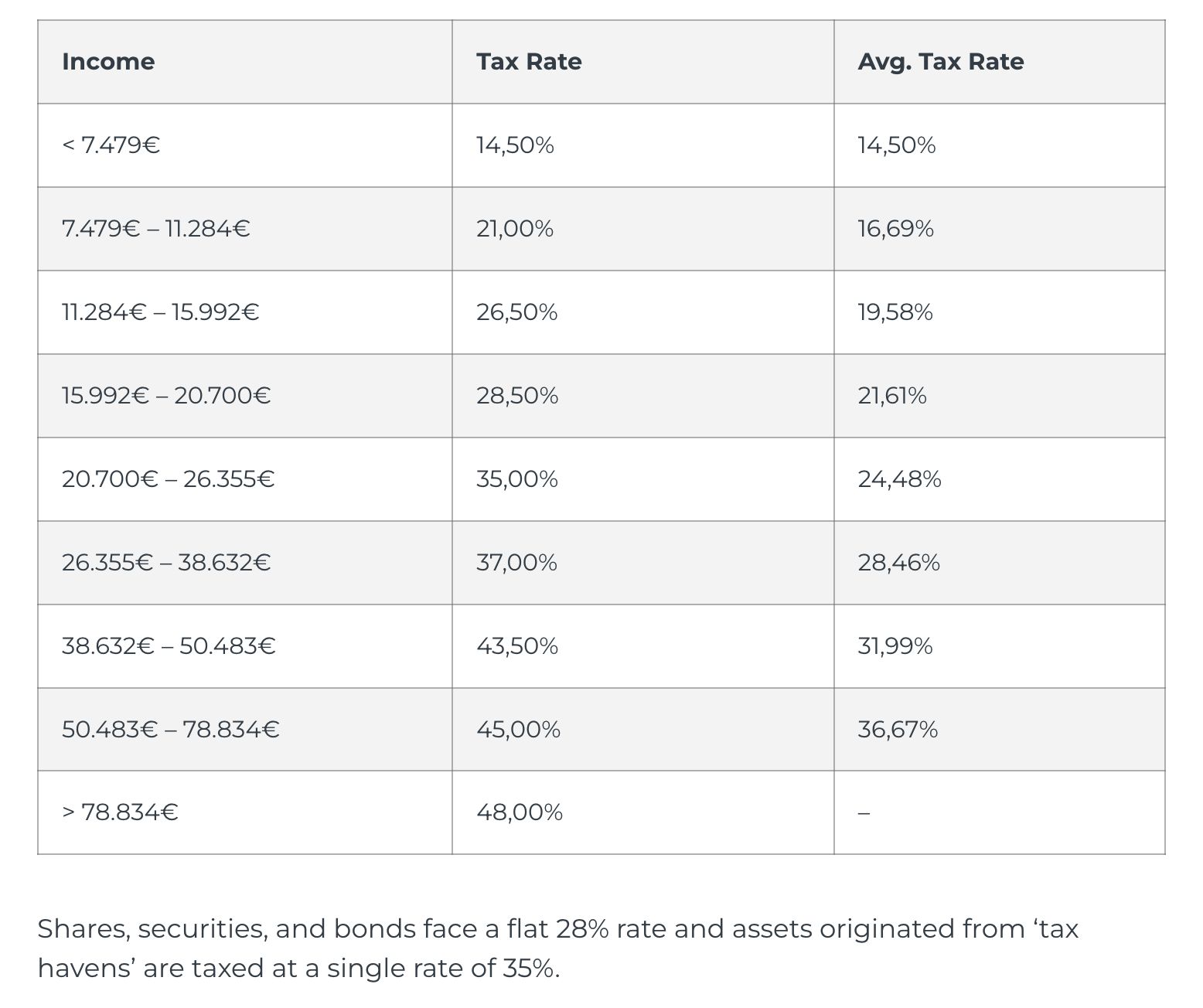

When it comes to real estate, the gains derived from property sales are integrated into your annual income and taxed using a progressive scale, which is another important element of tax rates in Portugal. This scale ranges from 14.5% to 48%, depending on the total income amount, including income for expats. Therefore, individuals with higher incomes typically face higher tax rates on their real estate gains.

To learn more about Capital Gains Tax, finish reading the article here