The pound takes a nosedive

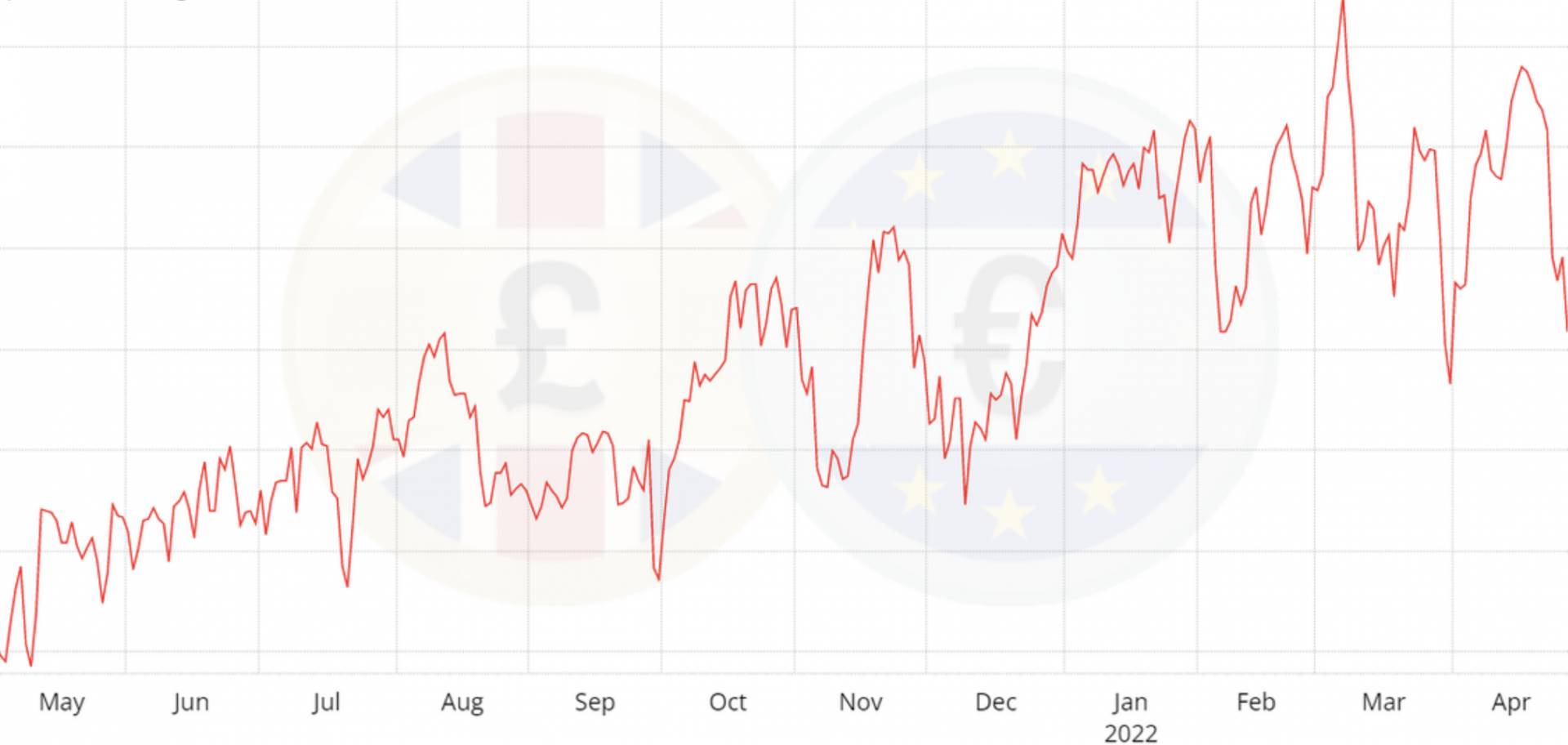

GBP/EUR

The Pound has taken a nosedive partly due to the mounting cost of the living crisis in the UK. At the moment the pound does not particularly look attractive to investors as the cost of living crisis is weighing heavy on the pound and the Bank of England’s less aggressive stance on rate hikes despite rising inflation.

GBP/EUR has dropped over 2% from April’s highs and nearly 3% against the 6-year highs seen in March.

On €200,000 that is a difference of £4,747.

There’s no real macroeconomic data of note out of the UK this week, so markets will likely already have one eye on the MPC’s policy announcement next week. While another 25 basis point rate hike is widely expected, the big uncertainty surrounds the bank’s view on the possible pace for additional hikes beyond next week’s meeting. This is shaping up to be a key event risk for the Pound.

With the Russia/Ukraine war continuing and economic growth concerns, it is important to keep an eye on the exchange rate and how it will affect your upcoming payments.

Spartan FX can monitor the rate for you, and you also have the option of buying your Euros in advance of any completion dates.