Currency News

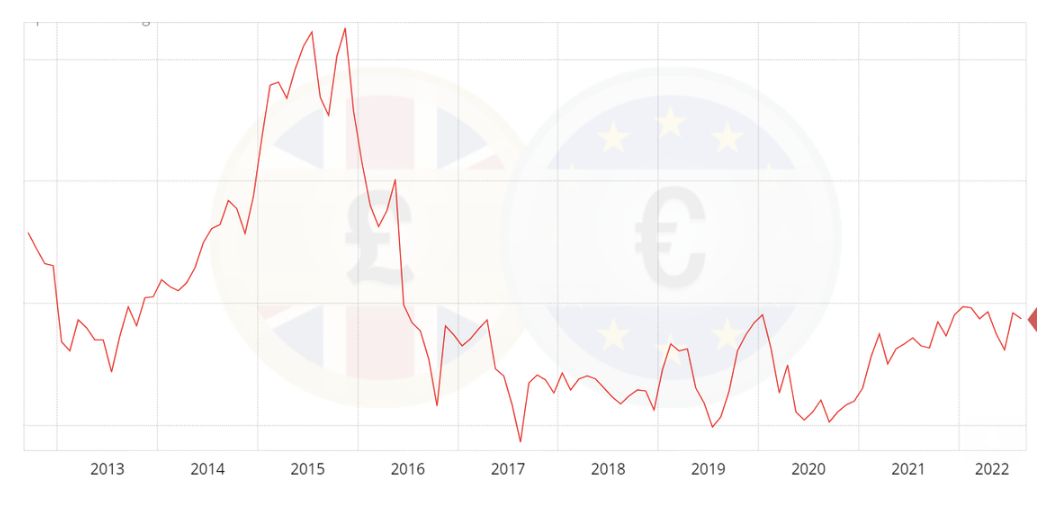

GBP/EUR Update

GBP/EUR is currently down nearly 1% on the day following a very doom and gloom assessment of the UK economy from the bank of England. Despite this drop, we are still at the best levels we have seen in the past few months.

What has caused this movement?

Yesterday the bank increased its base rate as expected by 50 basis points to 1.75%, the largest single rate hike since 1995. However, the vote for the rates was more weighted than expected, with 8 out of the 9 MPC members in support of an immediate 50bp rate increase. While ordinarily this would be seen as positive, the communications that followed quickly stopped the pound in its tracks.

The MPC has revised its inflation forecasts. UK headline inflation is now expected to peak at 13.3% in October. The main focus among committee members clearly surrounds controlling inflation at the expense of growth. In his press conference, governor Bailey said that “returning inflation to the 2% target remains our absolute priority.” He also justified the larger hike by saying that there were indications that price pressures had become more of an issue. Of particular concern is the bank’s appraisal of the impact of the cost of the living crisis on economic activity.

Policymakers now expect the UK economy to contract in the final quarter of 2022 and each quarter throughout 2023. This would mark the longest downturn witnessed in the UK since the 2008 financial crisis. This is a far sharper downturn than investors had accounted for, hence the initial knee-jerk sell-off in the Pound.

What could cause the Pound to weaken further?

Going forward, we still need to consider the impact of rising energy prices and the threat of a recession that will put further pressure on the Pound.

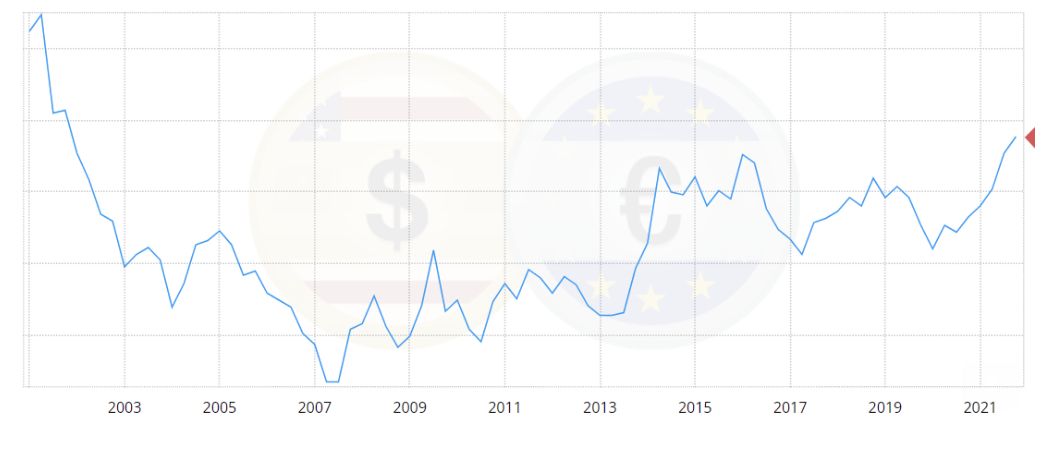

USD/EUR Update

Still, the best time to buy Euros in 20 years

The US Dollar weakened recently on the back of comments from the FED chair Jerome Powell. He expects energy prices to come down naturally. This would slow inflation and reduce the need for the aggressive rate hikes already priced in. While we have dropped from the peak seen in July, we are still trading at levels last seen in 2002!

The central bank is still struggling to curb inflation, but the threat of a US recession is putting pressure on the Federal Reserve to wind down its hiking cycle. Speculation for a looming shift in monetary policy may fuel a larger shift in the exchange rate as the central bank aims to achieve a ‘soft landing’ for the US economy.

What could cause the US Dollar to weaken?

The US going into recession in Q4 of this year. The Eurozone going into recession at the same time.Any change to the war between Russia and Ukraine. A ceasefire would take pressure off the global supply chain. The timing of your exchanges is key

What are your options?

Speak to an expert at Spartan FX now.

Call +44(0)203 984 0450

Email: kippertree@spartanfx.co.uk

Enquiry form: Click Here

Spartan FX - Official Currency Partner to KipperTree.