RATE ALERT - EUR/USD

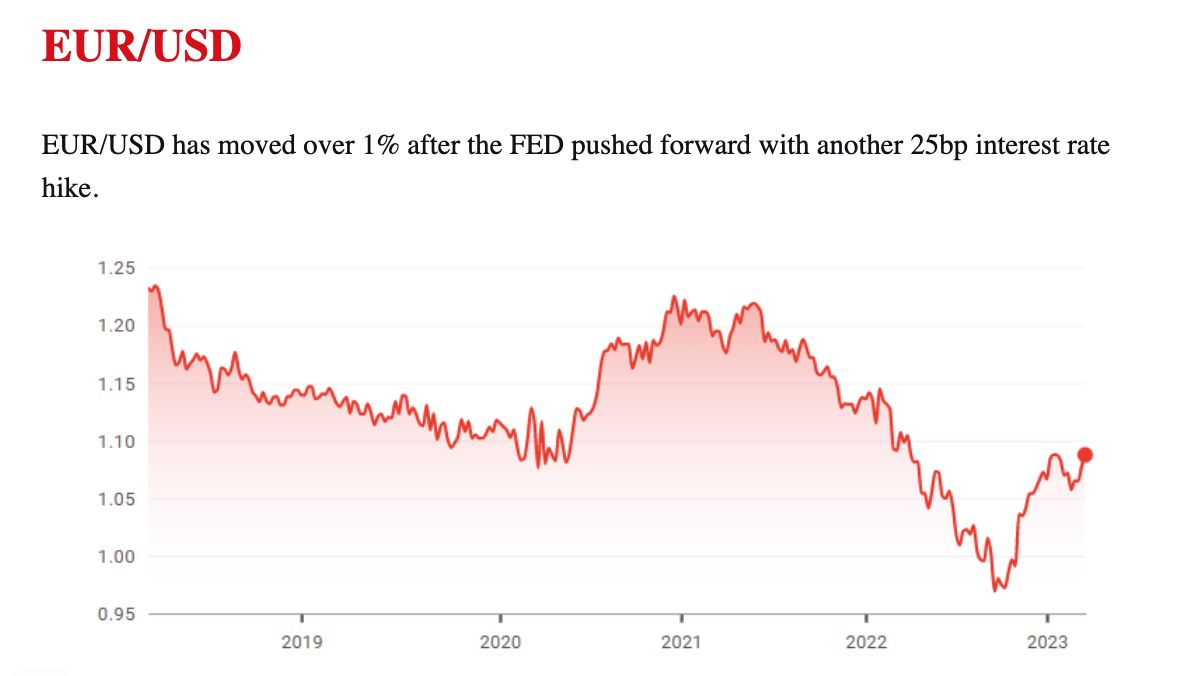

EUR/USD

Article by Spartan FX - Official Currency Partner to KipperTree

23 03 2023

The main driver of this is the collapse of the Silicon Valley Bank, a potential banking crisis and the need to still deal with inflation.

Cutting interest rates would help the banking sector; however, the FED has chosen to increase interest rates rather than raise more concern about the state of the banking system and to curb rising inflation.

Volatility

With the last two weeks being extremely volatile on the back of the banking crisis, trying to predict the outlook during these current times is proving to be very difficult.

Since the beginning of the year, the exchange rate has moved nearly 4% on €250,000, which is a difference of nearly $10,000.

If you want any certainty with your currency exchange, feel free to contact us and we can explain all of the options available to you.

What to watch out for

The US government cannot underwrite all banks. The US Dollar could collapse very quickly.

There is a stark difference between how the FED and ECB fight inflation. This is causing the Euro to strengthen.

The Ukraine/Russia war. Should we see any end to the war, this would ultimately be positive for the Euro and still one to watch.

Despite being on a downward trend, we are still at the highest levels in 20 years. Historically it does not stay at these levels for long.

What are my options

Option 1 - Buy your Euros in advance

There is no minimum, and Spartan FX can hold your funds on account free of charge.

Option 2 - Fix the rate with a 10% deposit

Fix the rate for a payment that needs to be made in the future.

Option 3 - Split your transfers

Splitting your payments means that if the rate moves against you, the average rate at which you will have bought your Euros will be better.

CALL NOW +44(0)203 984 0450

Copyright (C) 2023 Spartan FX. All rights reserved.

www.spartanfx.co.uk

Our mailing address is:

Spartan FX

Pixel Business Centre

110 Brooker Road

Essex, Greater London EN9 1JH

United Kingdom